The FoFundAide is an application which helps alternative investments manager as a real time monitoring tool to monitor positions in the futures and options exchanges around the world. We have redesigned the application from the Java/ Applet to Java/ Adobe Flex for current implementation. Current implementation in Adobe Flex targeted to achieve functionalities:

- Scalable to fit for manager with multiple accounts: funds-of funds, including CPOs, with allocations to several CTAs.

- Ability to designate which parties can access FundAide: single accounts to each CTA; groups of accounts to internal portfolio managers; or the entire position to internal/external designated parties.

- Does not require the purchase of any additional equipment or software.

- Additional tools such as value-at-risk, Historical Analysis, CTA Analytics and Archiving are planned to be implemented.

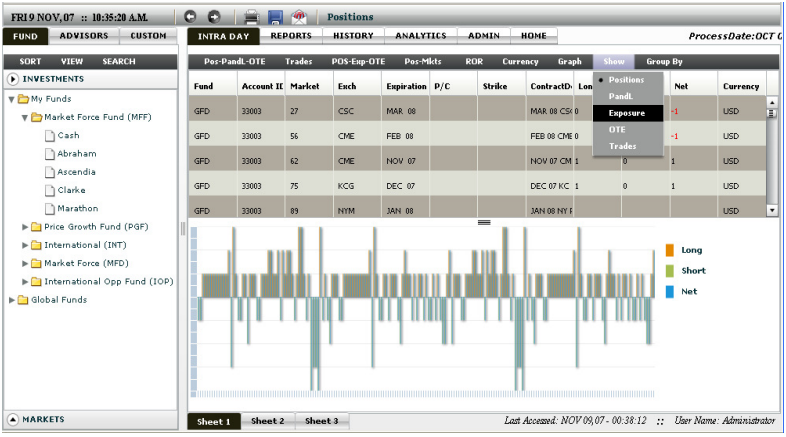

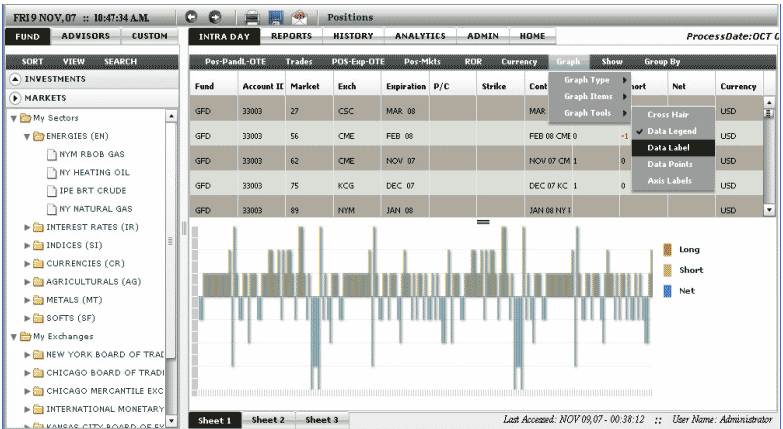

Real Time Monitoring:

Manager can monitor cash balances, open positions, P&L, commissions, margins and account equity in terms of each trade, instrument, maturity month, commodity, exchange, subgroups (e.g. Interest rates, Energies, Currencies…etc), account, account groups, or an aggregate of all accounts.

- The valuation of the positions will be updated throughout the trading day; the frequency of the real-time updates depends upon the frequency of the data feed and the frequency of the Positions files information received by FundAide and the frequency of data updates from FCM or Clearing Broker.

- Valuation can be expressed in terms of any major currency, such as U.S. Dollar, Japanese Yen, Euro, Canadian Dollar, and others.

- Provides extensive interactivity, and the ability to view information in both tabular and chart (6-8 types) formats. The format and settings can be specified by the user. Built-in intelligence will remember the user’s preferred display types and settings.

- Any display can be saved and/or printed at the click of a button.

Reports:

FundAide comes with a library of standard report formats. Re-designed library formats, customized reports to suit the user’s unique requirements.

- Reports can be generated for the Aggregate Position. Drill-down capabilities permit reports for any group of accounts, any specific account, any market, any instrument, or any trade.

- Reports include not only cash balance, P&L, open position equity and total equity, but also commissions, accrued fees and expenses, and margins including margin deficit/excess.

- Value-at-risk can be built users using the VAR module.

- As in the case of real-time monitoring, all reports can be expressed in terms of any major currency.

Administration:

Typical scenario where Asset management Firm extends this application to its client, FundAide provides interface for:

- User Management where Users profiles created/ Deleted/ Edited.

- Assign selected list of Funds accessible to Users.

- Declare Global funds accessible to all the user community.

- Make changes to Fund and its accounts information such as Trading Level, Fees… etc.

- Create the Investor Class users who are investors in specific Funds.

- Assign access levels to permit Read/ Write privileges.

Typical Scenarios where we can Implement Fundaide either in flex or other client chosen technologies:

- Alternative Investment Management firms with Multiple Managed Accounts.

- Commodity Trading Advisors with Multiple Managed accounts and need to provide transparency to clients.

- Brokers, FCMs, Clearing Brokers that want to extend fast access to its clients on the trading.

- Equity and fixed income securities asset management firms.